Settlement Cycle Changes

Learn more about the changes to settlement periods.

To align with the new settlement cycle standards of the North American equity exchanges, the US, Canadian, and Mexicans markets are transitioning to a one-day settlement cycle. In the current market, standard settlement occurs two business days after trade takes place.

For JBWere, the above regulatory change impacts Citibank N.A. who acts as JBWere’s International Custodian on US equity exchanges. As a result, any trade-related settlements on the US, Canadian, & Mexican markets must be completed by Citibank N.A. within one day (T+1) of the transaction’s execution instead of two business days.

For Canadian and Mexican markets this change will occur from Monday 27 May 2024.

For US markets this change will occur on Tuesday 28 May 2024.

US markets example:

- Trade Date 22.05 = Settlement Date 24.05 (T+2)

- Trade Date 23.05 = Settlement Date 28.05 (T+2)

- Trade Date 24.05 = Settlement Date 29.05 (T+2)

- Trade Date 27.05 = Exchange closed for Public Holiday

- Trade Date 28.05 = Settlement Date 29.05 (T+1)

- Trade Date 29.05 = Settlement Date 30.05 (T+1)

This is a regulatory change in the US, Canadian and Mexican jurisdictions that impacts Australian investors. Shortening the settlement cycle aims to create more efficient markets that serve our clients better; and to help keep traditional financial markets relevant and attractive to investors.

With the move to one-day settlement, investors benefit from quicker access to funds following trade execution and settlement; and are in the market more quickly on investments. Reducing the settlement cycle to one day (T+1) is one less day of market risk exposure between trade and settlement dates.

Securities that are not eligible for one-day settlement include:

- Non-eligible securities including contracts for an exempted security, government security, municipal security, commercial paper, bankers’ acceptances, commercial bills, and security-based swaps.

- Physicals, free of payment transactions, and securities that settle at the Fed are also non-eligible securities for ID settlement.

Yes. If a sell trade is placed on a two-day settlement market, for example, ASX, the buy trade will need to be placed a day later on a one-day settlement market for both transactions to settle on the same day. This is because funds from the T+2 market will not be available to settle the one-day market, if traded on the same day.

Working example:

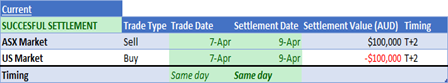

Current State

On 7 April, a client sells 2,400 BHP shares on the ASX Market and buys 365 Apple shares on the US Market

- If the orders are placed the same day (7 April), the ASX order will settle on T+2 (9 April), which means the $100,000 funds from the sell will only be available on 9 April for the buy trade.

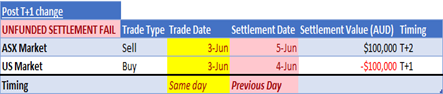

Future settlement

On 3 June, a client sells 2,400 BHP shares on the ASX Market and buys 365 Apple shares on the US Market

- If the orders are placed the same day (3 June), the ASX order will settle on T+2 (5 June), which means the $100,000 funds from the sell will only be available on 5 June. The US buy trade will require funding a day earlier at T+1 (4 June) and therefore fail.

- If the orders are placed on sequential days (3 June for ASX [T+2] and 4 June for the US [T+1]) the two settlement amounts will net-off on the same settlement day (5 June) and settle successfully.

There is no change to settlement fees.

As per the JBWere Multi-Asset Platform – Part 2 – Fees and other costs Guide, we may charge up to 15% pa (calculated daily and charged monthly with a minimum of $50 per month) of the value of the trade for early and failed settlements on listed investments until the amount outstanding is paid. We may also recover the costs of any charges incurred if a direct debit, direct credit, or cheque is dishonoured. These fees will be deducted from your Cash Account when JBWere incurs a cost.

For any currency conversion to/from USD, the default settlement period will be one-day settlement. This applies to equity linked trades or movements within the Multi Currency/ FX account, and funds will be instantly available.